Starting A Business

Starting a Business After Bankruptcy

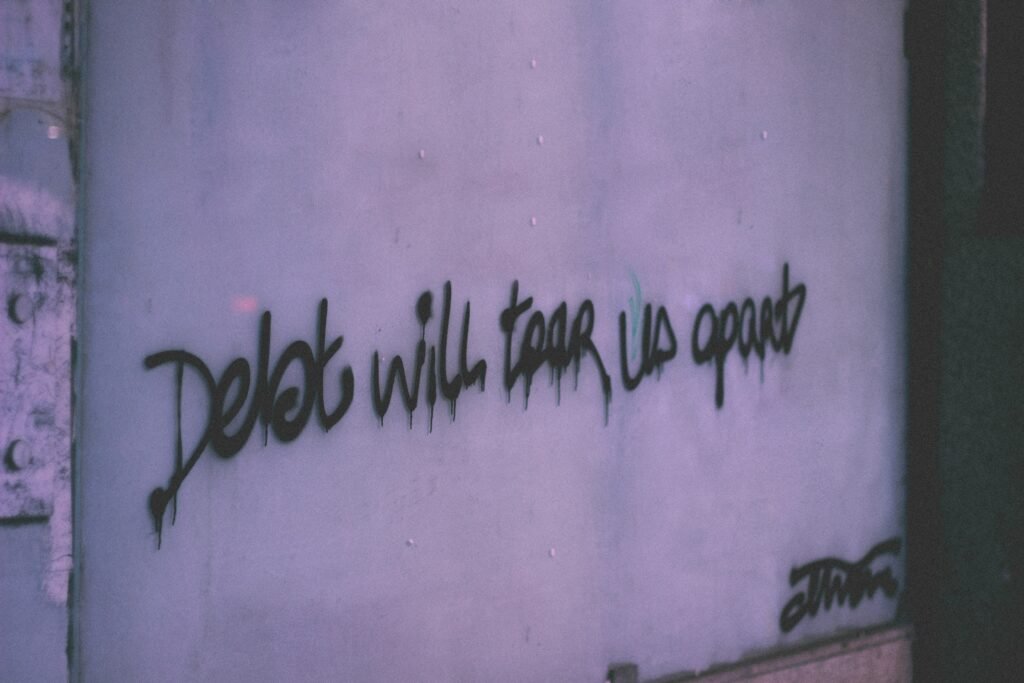

Bankruptcy can feel like a significant financial setback, but it’s also an opportunity to start fresh and rebuild your financial life. For those with entrepreneurial aspirations, starting a business after bankruptcy is not only possible but can also be a powerful way to regain financial independence. By taking strategic steps and planning carefully, you can turn your business dreams into reality while navigating post-bankruptcy challenges.

Step 1: Assess Your Financial Situation

Before starting a business, it’s crucial to evaluate your current financial position:

Understand Bankruptcy Terms

Depending on the type of bankruptcy filed (e.g., Chapter 7 or Chapter 13), there may be restrictions or requirements you need to follow.

Review Credit Reports

Ensure your credit report is accurate and reflects the discharge of debts.

Set a Budget

Determine how much capital you can realistically allocate toward your business without jeopardizing your personal finances.

Step 2: Develop a Solid Business Plan

A well-thought-out business plan is essential for success, especially after bankruptcy:

Define Your Goals

Clearly outline your business objectives, target audience, and unique value proposition.

Estimate Startup Costs

Include all potential expenses such as equipment, inventory, marketing, and licensing.

Create Financial Projections

Demonstrate how your business will generate revenue and achieve profitability.

Plan for Challenges

Address potential obstacles and outline strategies to overcome them.

Step 3: Explore Financing Options

Securing funding after bankruptcy can be challenging, but there are several options to consider:

Personal Savings

If possible, use personal savings to finance your startup.

Friends and Family

Borrowing from trusted individuals can provide initial funding, but be sure to formalize agreements to avoid misunderstandings.

Small Business Grants

Look for grants specifically designed for new entrepreneurs or those rebuilding after financial hardship.

Microloans

Nonprofit organizations and community lenders often provide small loans to help startups.

Crowdfunding

Platforms like Kickstarter or GoFundMe can help you raise funds from a broad audience.

Secured Credit Cards

Use a secured card to rebuild credit and cover small expenses.

Step 4: Rebuild Your Credit

Improving your credit score will increase your access to better financing options:

Pay Bills on Time

Pay Bills on Time

Keep Debt Levels Low

Avoid taking on unnecessary debt while starting your business.

Monitor Credit Reports

Regularly check your credit report for accuracy and signs of improvement.

Step 5: Choose a Business Structure

Selecting the right legal structure for your business can protect your personal assets:

Sole Proprietorship

Simplest structure but doesn’t separate personal and business liabilities.

LLC (Limited Liability Company):

Protects personal assets from business debts and is a popular choice for small businesses.

Corporation

Offers more extensive liability protection but involves additional paperwork and costs.

Step 7: Start Small and Scale Gradually

Minimize financial risk by starting your business on a small scale:

Test Your Idea

Begin with a pilot project or limited product launch to gauge demand.

Bootstrap

Focus on generating revenue quickly by using cost-effective methods to grow your business.

Reinvest Earnings

Use profits to fund expansion rather than taking on additional debt.

Step 6: Leverage Free Resources

Many organizations offer support for entrepreneurs rebuilding after bankruptcy:

SCORE

Provides free mentoring and business advice from experienced professionals.

Small Business Administration (SBA):

Offers tools, resources, and funding programs for small businesses.

Local Business Development Centers

Provide training, counseling, and networking opportunities.

Step 8: Stay Compliant with Legal Requirements

Ensure your business operates within the law:

Obtain Necessary Licenses

Research and secure any required permits or licenses for your industry.

Follow Bankruptcy Rules

Comply with any remaining obligations or restrictions related to your bankruptcy case.

Pay Taxes

Stay on top of business tax filings and payments to avoid future financial issues.

Starting a business after bankruptcy requires determination, careful planning, and a willingness to learn from past mistakes. By rebuilding your credit, exploring creative financing options, and leveraging free resources, you can create a successful business and take control of your financial future. Remember, bankruptcy is not the end—it’s a chance for a new beginning, and your entrepreneurial journey can be a vital part of that transformation.